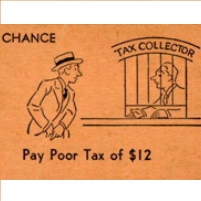

Taxes to Go Up for Lowest-Income Americans

Thursday, January 13, 2011

It turns out that the great tax compromise hammered out between President Barack Obama and congressional Republicans will not prevent taxes from going up for many Americans, mainly low-income earners.

An analysis of the tax bill by the Urban Institute-Brookings Tax Policy Center shows that 67% of individuals in the lowest-earning group (the 20% who earn less than $18,196 a year) will pay more this year in taxes. The majority of those in the bottom 40%, those earning less than $35,525 a year, are the only income group the majority of whose members will pay more taxes. The number of people affected is estimated to be more than 50 million.

The source of the tax hike lies with the government’s decision to replace the Making Work Pay tax credit in 2010 with a 2% reduction in the payroll tax rate in 2011.

“This change could have been designed in a way that avoided an increase for most low-wage workers—consistent with the President’s statement that ‘there is no reason that ordinary Americans should see their taxes go up next year’—but it was not,” writes Shawn Fremstad, with the Center for Economic and Policy Research.

-Noel Brinkerhoff

The Tax Deal's Biggest Losers: 40 Million Low-Wage Workers Who Will See their Taxes Go Up This Year (by Shawn Fremstad, Center for Economic and Policy Research)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

- Donald Trump Has a Mental Health Problem and It Has a Name

- Trump Goes on Renaming Frenzy

Comments