District Attorneys Sell Letterheads and Seals to Debt Collectors

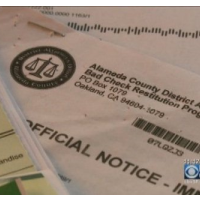

Collection notice with DA letterhead (photo: CBS)

Collection notice with DA letterhead (photo: CBS)

Nearly seven years ago, Los Angeles Times columnist David Lazarus wrote incredulously about the regular practice of county district attorneys accepting fees from private debt collectors who use official letterheads and threaten criminal punishment if restitution and fines aren’t forthcoming.

This week, someone filed a class-action lawsuit in U.S. District Court for the Northern District of California to stop it.

The complaint, filed on behalf of three plaintiffs from the counties of Alameda, Sacramento and Orange, alleges that debt collector CorrectiveSolutions pretends to be the DA and “uses false and misleading threats of criminal prosecution to intimidate Californians who have written checks that are dishonored by the bank. . . . The company pays county district attorneys for the use of their seal and letterhead, thereby disguising its ordinary civil debt collection as law enforcement.”

Back in 2008, Kirk Barrus, senior vice president of American Corrective Counseling Services, pretty much told Lazarus his debt collection agency was the government. “We operate under the total control of the district attorney. We're basically a secretarial service, and therefore should carry the district attorney's immunity. They're not letters from a private company. They're letters from a district attorney.”

It remains to be seen if that will be part of the defense argument.

This is part of the plaintiffs’ case. “Making a phony threat to put someone in jail unless they pay you money is called extortion,” attorney Paul Arons told the San Francisco Chronicle. “California district attorneys should be going after those doing the extortion, not teaming up with them.”

Au contraire. Teresa Drenick, a spokeswoman for the Alameda County District Attorney’s office, said the bad-check collection arrangement works. It saves the county time and money, keeps folks out of court, collects debts from chronic offenders and helps business. The office doesn’t vet every case and letter written, but they sign off on a list of debtors who can be contacted.

The Orange County Register said at least 20 counties have similar arrangements with debt collectors. They don’t make much money renting out their letterheads, prompting some critics to question why they are subsidizing private civil collections. The lawsuit maintains that most of the collection referrals come from corporations like Target and Safeway, not district attorney offices.

Lead plaintiff Kevin Breazeale lives in Alameda County. He gave a post-dated check to a car company to be held on a lease deal, realized he was short of funds and asked them not to cash it. They already had. He paid them the money separately and all was well until he received a collection notice from San Clemente-based CorrectiveSolutions. According to the lawsuit:

“The letter was on the letterhead of the Alameda County District Attorney, bore the signature block and signature of ‘Nancy O’Malley, District Attorney,’ and listed a ‘Case number.’ The letter said Mr. Breazeale was accused of a crime punishable by up to a year in prison. The letter said that Mr. Breazeale could avoid the possibility of further action by participating in the “Bad Check Restitution Program.” The letter also said that Mr. Breazeale had to attend a Financial Accountability class and pay a total of $730.00” plus $230 in other fees.

The lawsuit asks the court to grant the plaintiffs class-action status and make the DAs stop doing what they’re doing. They also want money for restitution, damages and costs.

While the court weighs the legal issues in the case, the American Bar Association has addressed the ethical aspects. Earlier in the month, it published Formal Opinion 469 (pdf):

“A prosecutor who provides official letterhead of the prosecutor’s office to a debt collection company for use by that company to create a letter purporting to come from the prosecutor’s office that implicitly or explicitly threatens prosecution, when no lawyer from the prosecutor’s office reviews the case file to determine whether a crime has been committed and prosecution is warranted or reviews the letter to ensure it complies with the Rules of Professional Conduct, violates Model Rules 8.4(c) and 5.5(a).”

That first model rule doesn’t sound like a good one to violate. “It is professional misconduct for a lawyer to engage in conduct involving dishonesty, fraud, deceit or misrepresentation.” The other one warns lawyers not to help non-lawyers practice law.

As the Formal Opinion states, the Bar Association “has written about lawyers working for and with creditors to collect allegedly delinquent debts” since at least 1932. Many of the writings address the unauthorized practice of law.

Apparently, there is a lot to say on the subject.

–Ken Broder

To Learn More:

Collectors Slammed for Renting DA Letterhead (by Katherine Proctor, Courthouse News Service)

Suit Calls Debt Collection Deceptive; Firm Uses D.A.’s Seal (by Bob Egelko, San Francisco Chronicle)

San Clemente Debt Collector Sued over Using D.A.'s Seal to Scare Consumers into Paying Up (by Tony Saavedra, Orange County Register)

Our Civil Liberties Lose This Round (by David Lazarus, Los Angeles Times)

Formal Opinion 46: Prosecutors and Debt Collection Companies (American Bar Association) (pdf)

Brezeale v. Victim Services, Complaint (U.S. District Court for the Northern District of California)

- Top Stories

- Controversies

- Where is the Money Going?

- California and the Nation

- Appointments and Resignations

- Unusual News

- Latest News

- California Forbids U.S. Immigration Agents from Pretending to be Police

- California Lawmakers Urged to Strip “Self-Dealing” Tax Board of Its Duties

- Big Oil’s Grip on California

- Santa Cruz Police See Homeland Security Betrayal in Use of Gang Roundup as Cover for Immigration Raid

- Oil Companies Face Deadline to Stop Polluting California Groundwater