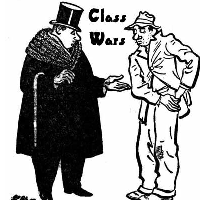

U.S. Government Redistributes Wealth…to the Rich

For about thirty years now, the federal government has been implementing policies that take tax dollars from middle class Americans and give them to the rich, supposedly as a way to spur economic growth. Although Americans actually want greater economic equality, the net effect has been to redistribute wealth to the rich and create the most unequal developed society on earth.

According to a series of reports by Reuters, since 1989 inequality has risen all across the U.S. to levels not seen since before the Great Depression:

• Inequality has increased in every state except Mississippi, which is the poorest state in the Union;

• The poverty rate increased in 43 states;

• In 28 states inequality and poverty rose while median income fell;

• In every state, the richest 20% of households far outpaced the income gains of any other quintile;

• Income for the median household fell in 28 states.

Three specific aspects of federal policy—low taxes for the rich, outsourcing government functions to private companies, and the financial clout of Washington lobbyists—have been the major drivers of growing inequality.

Low taxes for the rich

Tax cuts enacted during the administrations of Presidents Ronald Reagan and George W. Bush cut taxes sharply on the wealthy, redistributing nearly $2 trillion to high income families—just in the past ten years. In 2011, the nonpartisan Congressional Budget Office and Congressional Research Service each studied income inequality and concluded that the cuts made the tax system less progressive and were the second biggest contributor to growing inequality.

Outsourcing

Starting under President Bill Clinton’s “reinventing government” initiative, the federal government has directed trillions of tax dollars to private-sector contractors by outsourcing government operations that would previously have been performed by government employees. Federal money flowing to business rose 7% during Clinton’s second term and 72% percent under Bush, before leveling off in 2010. This has contributed to inequality because private employers typically offer lower skilled workers less job security, lower wages and fewer benefits than the federal government does.

Lobbying

Nearly 13,000 registered lobbyists reported $3.3 billion in fees last year. There are 22% more lobbyists than in 1998, and their inflation-adjusted revenue is 37% higher than in 1998. Because re-election to Congress is so expensive, the campaign contributions that lobbyists influence or control are critical to political survival on Capitol Hill. But lobbyists work overwhelmingly for groups representing social elites. According to a study led by Prof. Kay Schlozman, the majority of lobbying groups exist to advance the interests of business, while groups advocating for union workers and the poor came in last and second to last on the list.

-Matt Bewig

To Learn More:

Redistributing Up (by Deborah Nelson and Himanshu Ojha, Reuters)

Average U.S. Household Has Lost 5% in Annual Income Since Economic “Recovery” Began (by Matt Bewig, AllGov)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Musk and Trump Fire Members of Congress

- Trump Calls for Violent Street Demonstrations Against Himself

- Trump Changes Name of Republican Party

- The 2024 Election By the Numbers

- Bashar al-Assad—The Fall of a Rabid AntiSemite

Comments