Tax-Exempt Organizations Still Have to Pay Payroll Taxes…and Owe at least $875 Million

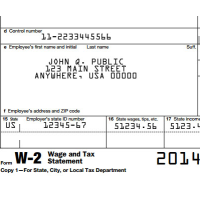

(graphic: Steve Straehley, AllGov)

(graphic: Steve Straehley, AllGov)

Receiving tax-exempt status from the Internal Revenue Service means a group avoids paying income taxes, but they still must pay payroll taxes.

This fact of the federal tax code has been lost on more than 64,000 organizations that collectively owed the government $875 million in back taxes as of 2012, according to the Treasury Inspector General for Tax Administration (TIGTA). The number of groups in arrears is “small,” only 3.8% of such organizations, according to TIGTA.

About 1,200 of them owed more than $100,000 each. Nine had federal “tax debt spanning 10 or more years that collectively totaled more than $5.5 million,” TIGTA said in its report.

TIGTA looked at 25 of the worst offenders. “These organizations generally received government payments over a three‑year period of $148 million, including Medicare, Medicaid, and government grants; had annual revenue of almost $167 million; and owned assets of more than $97 million, but continued to not remit payroll and other taxes, including penalties and interest, totaling more than $25 million,” the report said.

The IRS is not authorized to revoke an organization’s tax-exempt status based on non-payment of payroll taxes.

-Noel Brinkerhoff, Steve Straehley

To Learn More:

Some Tax-Exempt Organizations Have Substantial Delinquent Payroll Taxes (Treasury Inspector General for Tax Administration)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Musk and Trump Fire Members of Congress

- Trump Calls for Violent Street Demonstrations Against Himself

- Trump Changes Name of Republican Party

- The 2024 Election By the Numbers

- Bashar al-Assad—The Fall of a Rabid AntiSemite

Comments