Mitt Romney’s Tax Plan Would Help…Mitt Romney

Wednesday, June 06, 2012

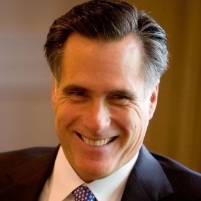

A victory in November could be twice as sweet for Republican presidential candidate Mitt Romney.

If Romney defeats President Barack Obama, the Republican would be able to implement his tax-cut plan for the nation—and save $4.8 million on his own taxes compared to Obama’s proposed tax plan.

This savings was calculated by the Associated Press using numbers provided by the liberal-leaning Citizens for Tax Justice and the conservative-leaning Tax Foundation.

Under Romney’s proposal, the highest tax bracket would drop from 35% to 28%. Romney’s net worth is about $220 million, which puts him in the richest one one-thousandth of one percent of Americans. According to his tax return for 2010, his annual income was $21.6 million, more than half of which came from capital gains, which are taxed at a lower rate than earned income.

Romney also wants to do away with the alternative minimum tax, which impacts the wealthy and some middle-class taxpayers. More tax savings would come from repealing Obama’s health care law.

-Noel Brinkerhoff, David Wallechinsky

To Learn More:

Obama Win Could Cost Romney $5M in Personal Taxes (by Connie Cass, Associated Press)

- Top Stories

- Unusual News

- Where is the Money Going?

- Controversies

- U.S. and the World

- Appointments and Resignations

- Latest News

- Trump to Stop Deportations If…

- Trump Denounces World Series

- What If China Invaded the United States?

- Donald Trump Has a Mental Health Problem and It Has a Name

- Trump Goes on Renaming Frenzy

Comments